Compare our latest business expense account deals and apply online, view and manage your business expenses in one place.

For businesses with 20+ employees

Built-in expense management system

Extra cards with optional restrictions

We're on a mission to improve the finances of the nation by helping you to spend wisely and save money

We're on a mission to improve the finances of the nation by helping you to spend wisely and save money

By Laura Rettie, Personal Finance Journalist.

Business expense accounts are a great way to manage your company expenses. Find out more about expense accounts and how you can find the best deal.

It’s money you pay out to keep your business running which can include the things you do to increase profits, your regular costs like rent you pay for office space or variable outgoings like staff expenses.

Examples of business expenses are:

For accounting purposes, there are different types of expenses.

Fixed expenses are things your business has a legal obligation to pay like rent, mortgage or business rates. These costs occur regularly and the amounts are fixed.

Periodic expenses are costs that are often planned for but less predictable, they could be things like utilities or maintenance bills that differ from month to month or only need to be paid quarterly or annually.

Variable expenses are costs that are flexible and changeable and hard to plan for. For example, travel costs, repairs, goods and services or staffing expenses.

Expense management is a way of processing payments and reporting on staff expenses claims.

Whether you’re a small, medium or large company you'll need to track and audit money flowing in and out of your business.

Companies use a range of methods to track business expenses. Here are some examples of expenses systems used:

The more staff you have, the harder expenses are to manage. The trickle of receipts and reimbursements becomes a stream of constant claims and payments.

Good expense management is vital for a company to stay on top of its costs and outgoings especially when it comes to variable expenses like employee costs and staff expenses.

If your business is not in control of expenses then it will not only fail to make forecasted profits but your business could become susceptible to fraud.

Businesses traditionally handled expenses using a petty cash book or ledger alongside their business accounting. This is paper-based and relies on the provision of receipts. Many small businesses still operate this system, albeit with bookkeeping software or Excel spreadsheets.

Another way businesses manage expenses is by operating a cash advance system, which operates largely on trust and can get complicated when the sums requested don’t match the actual outlay and need to be reconciled.

Some businesses provide employees with business credit cards or company prepaid cards which means that employees don’t need to use money from their own bank accounts to pay for business expenses.

This method of business expenses management presents the possibility of fraud or misuse and could mean extra expenses and hidden costs for the business owner.

It’s a bank account for businesses to help save time and costs on managing finances, such as:

Business expense accounts can provide companies with an expense management platform which allows them to keep on top of staff expenses and budgets.

Not all expense accounts are the same, so it’s worth shopping around and comparing what each account has to offer.

The sort of features and benefits you may expect are:

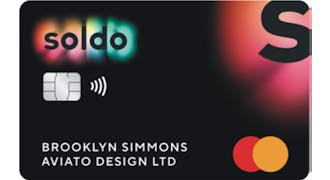

Company cards are employee spending cards that mean that your team no longer have to use their own cash or cards for expenses like travel or accommodation.

Depending on the type of business expenses account you choose, company cards can be:

Some company cards are linked to a mobile app for real-time spending insights and receipt capture.

Company cards can be used for almost anything but you can define your business or team spending rules. For example, you may choose to limit expenses to fuel stations, train travel and named hotels only.

Another useful feature of many business account spending cards is that you can set individual spending limits for each employee.

Business payment cards can also be used for departmental or project spending so you can set a budget for your team and define the spending rules.

This allows monitoring of real-time expenditure and means you can reign in any overspending and keep control of project finances.

Yes, but the way fees are charged varies according to the business expenses account provider. For this reason, it pays to shop around and compare different accounts.

Fees structures you may come across are:

Although many account providers offer a basic business accounting platform for free, to get the most useful expenses management benefits you’ll need to pay a monthly fee.

If you’re the owner of a small business or a sole trader you may find that a simple business bank account is sufficient for managing and tracking expenses.

Prepaid business cards are a good option if you want to give your team the freedom to manage their own expense account but limit spending. However, you’ll need to plan for this option and know how much to load or top up in advance.

Another alternative is to issue corporate credit cards or debit cards to designated employees. This means staff don’t have to fork out for expenses upfront and reclaim petty cash and your business doesn’t have to reconcile cash advances or accumulate paper receipts.

However, whilst prepaid business cards, debit and credit cards are more efficient than petty cash or cash advances, your business will still need to track statements, process expense reports and reconcile payments on a monthly basis.

The information provided does not constitute financial advice, it’s always important to do your own research to ensure a financial product is right for your circumstances. If you’re unsure you should contact an independent financial advisor.

It depends on the type of company card issued. A prepaid company card or debit card will not impact your credit rating.

A corporate credit card could potentially affect your credit score if you are the primary account holder or the business owner.

An authorised user will not have their credit checked, but if they abuse the card it could adversely affect the primary account holder's credit rating.

Potentially anywhere, but some business expense accounts allow you to define spending rules so that a company payment card can only be used for specific hotels, restaurants or fuel stations.

Yes, the majority of business expenses accounts allow multiple company cards to be linked to one account. So, potentially all members of your team could have a card or alternatively, you could issue cards to senior members of the team or only staff that need one.

Even better, you can set individual spending limits to help your business to control outgoings. Bear in mind that a business will usually have to pay a fee for each card user and there may be a cap on how many cards can be linked.